FREE EDUCATION

It’s all very well having retirement savings as a financial goal, but just how much should you plan to have in your super balance now, and when you retire?

BSc. Econ, BCom, MBus

Authorised Representatives of Millennium Three Pty Ltd

ABN 61 094 529 987

AFSL 244252

It’s all very well having retirement savings as a financial goal, but just how much should you plan to have in your super balance now, and when you retire? Find out more about coming up with a super balance target, for your age group, and for the retirement lifestyle you have in mind.

If you have been in the workforce, your retirement savings will be growing because of Super Guarantee (SG). This is the compulsory contribution to super your employer must pay on your behalf. For most people, SG alone will not generate sufficient retirement savings. You can keep tabs on just how much you have by checking your latest super statement, logging onto your MyGov account, or your super fund’s online portal.

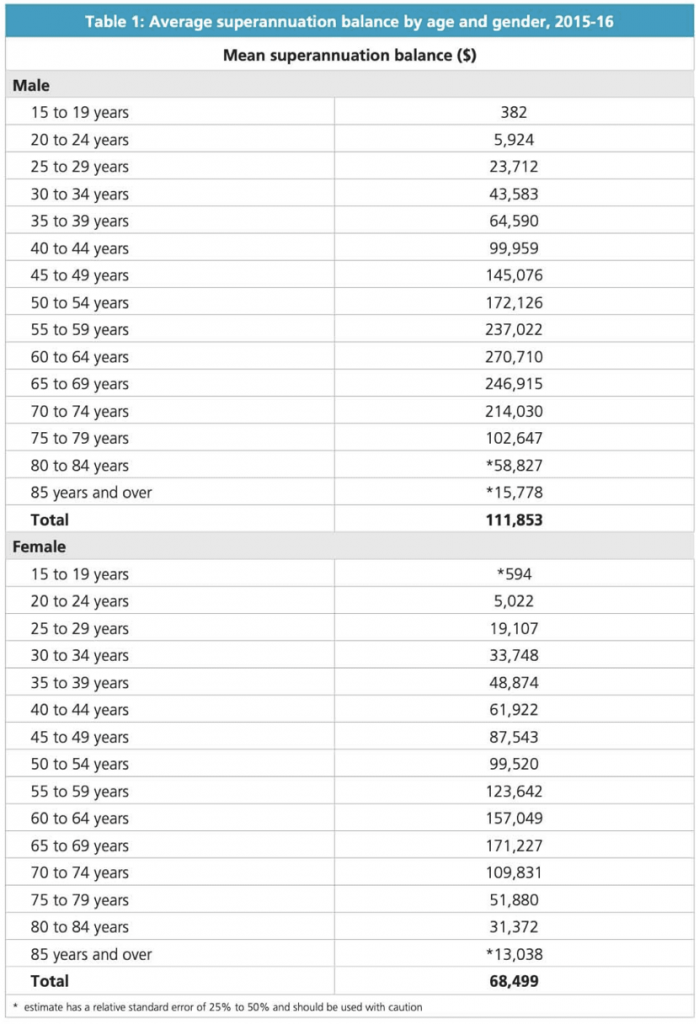

Once you’ve checked up on your super savings, how can you tell if it’s enough to see you living comfortably in retirement, whether that’s in 5 or 25 years’ time? To get an idea of how your super savings compare with others your age, the Association of Superannuation Funds of Australia (ASFA) has published average super balances held by different age groups, including figures for men and women.

So if you’re currently aged 40-44, your peers have an average balance of just over $80,000. That average rises to a peak of almost $215,000 in the years approaching retirement (60-64).

Putting a figure on how much you’ll need saved to cover your costs in retirement is a tricky task. There are so many unknowns for each of us, including when we’re going to retire, how long we’ll live once we do and what we’ll be spending our time doing. This is why many people seek advice from a financial planning professional to get financially ready for retirement. They can ask the right questions and help you run the numbers to give you a clear picture of your retirement goals and plan for the income you’ll need to achieve them.

To get a more general idea of what you can expect to spend in retirement, the ASFA publish retirement standard figures each quarter. As a well-researched estimate of what singles and couples will need to pay their bills for a modest or comfortable retirement lifestyle, these figures offer a rough idea of living costs. The Milliman Retirement Expectations and Spending Profiles (ESP) report is also published quarterly. Based on data gathered from 300,000+ Australian retirees, their reports put spending in retirement under the microscope to help people plan better for their financial needs in retirement. According to data and commentary from their February 2018 ESP report for example, Milliman found that over half of Australian retirees are actually living on less than the Age Pension each year.

Having said this, results from the 2017 FPA Live the Dream survey show that just 22% of baby boomers say they’re living the dream in retirement. And the number one obstacle standing in their way is a low bank balance (39%). So while a modest income may be enough to live on, perhaps a bigger nest egg is important for making retirement dreams come true.

As well as these different estimates about how much you’ll need in retirement, here are some important ideas to bear in mind if you’re uncertain about the importance of topping up your super with extra contributions:

Looking for a way to budget for extra super contributions? Salary sacrificing into super can be a great way to cut your tax bill and boost your super contributions at the same time.

CONTACT US

Let’s Connect

If you want to meet over a coffee (practising safe social distance), we’re more than happy to do that too.

Our standard hours are Monday to Friday from 8am – 6pm

After hour appointments are available upon request.

Write to us and we’ll be in-touch soon.

Subscribe to our latest insights and updates

Perspective Wealth Management Pty Ltd

ACN 639 529 749

Trading as Luck Financial Group is a corporate authorised representative of Millennium3 Financial Services Pty Ltd

ABN 61 094 529 987 – AFSL 244 252

The information displayed on this communication is a summary only and should not be construed as investment advice or securities recommendations. It is prepared for general information and not having regard to any particular persons investment objectives, financial situation or needs. No recommendation (express or implied) or other information should be acted on without obtaining professional advice. You are encouraged to consult a financial planner before making any decision as to how appropriate this information is to your objectives, financial situation and needs. Also, before making a decision, you should consider the relevant Product Disclosure Statement available from your financial planner. This website is for Australian residents only.

Website by Studio Quatro