Menu

FREE EDUCATION

Coronavirus cases continue to grow around the world. Italy (69,176 cases) and New York City (over 15,800 cases) are amongst the worst-affected areas.

BSc. Econ, BCom, MBus

Authorised Representatives of Millennium Three Pty Ltd

ABN 61 094 529 987

AFSL 244252

Coronavirus cases continue to grow around the world. Italy (69,176 cases) and New York City (over 15,800 cases) are amongst the worst-affected areas. Australian cases have also risen to 2,044 driven by Australians returning from overseas travel. This has seen governments react with major lockdowns on state borders and the inevitable shutdown of many businesses. Governments and central banks, such as the Reserve Bank, are acting to stimulate the economy and help people who have lost their jobs.

These moves have negative implications for the economy and mixed ones for your investments.

Government efforts to reduce virus cases include:

Our health response appears to be doing reasonably well with 8 reported deaths in Australia. For context other countries with similar numbers of infected cases had substantially more deaths and intensive care cases.

Some of these measures cause substantial economic damage with people in the hospitality sector amongst the hardest hit. Given pubs and restaurants for example have been forced to close for the foreseeable future, these employers have had little choice but to let staff go. This has seen a surge in Centrelink applications this week as reported in the media.

The government has been trying to help by announcing:

The government measures will help support people that lost their jobs because of the impact of this outbreak.However, there is also a higher chance of an Australian recession for the first time since the early 1990s because of the job losses and business shutdowns that are happening.In addition, there are flaws in the current stimulus that means recovering could take longer for our economy. We may see higher unemployment rates and increased Centrelink reliance for some time.

This will help the global economy eventually recover from the actions taken to stop the spread of the virus.

The Government stimulus and RBA policies will help stabilise the economy in the medium term.

Be prepared for:

Good news stories:

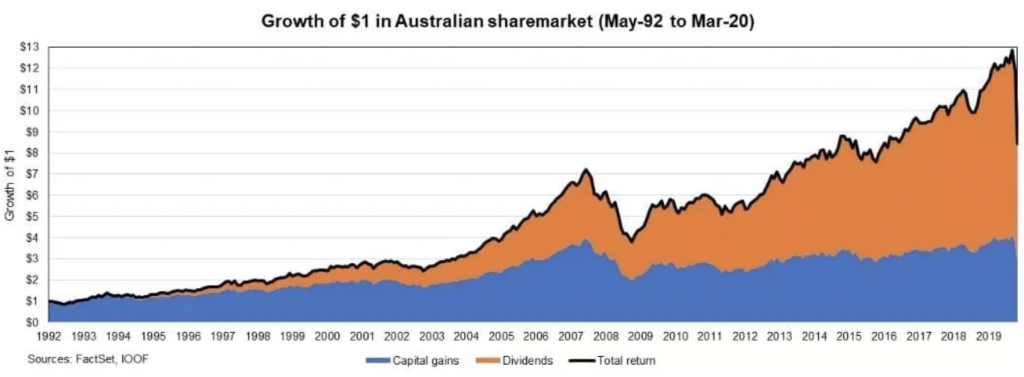

One of the best times to stay invested was at the end of the GFC in February 2009. Equity markets had fallen a lot and investors gained from holding and reinvesting those dividends back into their portfolios (to buy more shares).

CONTACT US

Let’s Connect

If you want to meet over a coffee (practising safe social distance), we’re more than happy to do that too.

Our standard hours are Monday to Friday from 8am – 6pm

After hour appointments are available upon request.

Write to us and we’ll be in-touch soon.

Subscribe to our latest insights and updates

Perspective Wealth Management Pty Ltd

ACN 639 529 749

Trading as Luck Financial Group is a corporate authorised representative of Millennium3 Financial Services Pty Ltd

ABN 61 094 529 987 – AFSL 244 252

The information displayed on this communication is a summary only and should not be construed as investment advice or securities recommendations. It is prepared for general information and not having regard to any particular persons investment objectives, financial situation or needs. No recommendation (express or implied) or other information should be acted on without obtaining professional advice. You are encouraged to consult a financial planner before making any decision as to how appropriate this information is to your objectives, financial situation and needs. Also, before making a decision, you should consider the relevant Product Disclosure Statement available from your financial planner. This website is for Australian residents only.

Website by Studio Quatro