Menu

FREE EDUCATION

When you’re looking at saving and planning for retirement, it’s important to know how much you can expect to be spending.

BSc. Econ, BCom, MBus

Authorised Representatives of Millennium Three Pty Ltd

ABN 61 094 529 987

AFSL 244252

When you’re looking at saving and planning for retirement, it’s important to know how much you can expect to be spending. The latest retirement standard figures and other data sources can give you an idea of the cost of retirement, but what else do you need to take into account to ensure your financial wellbeing?

Since June 2006, the Association of Superannuation Funds of Australia (ASFA) have been monitoring the living costs associated with retirement. Every quarter they research and publish the average annual budget singles and couples aged around 65 can expect to spend when living a modest or comfortable lifestyle in retirement. This is known as the “retirement standard” and for some time it’s been a popular yardstick for what it costs to live as a retired person in Australia.

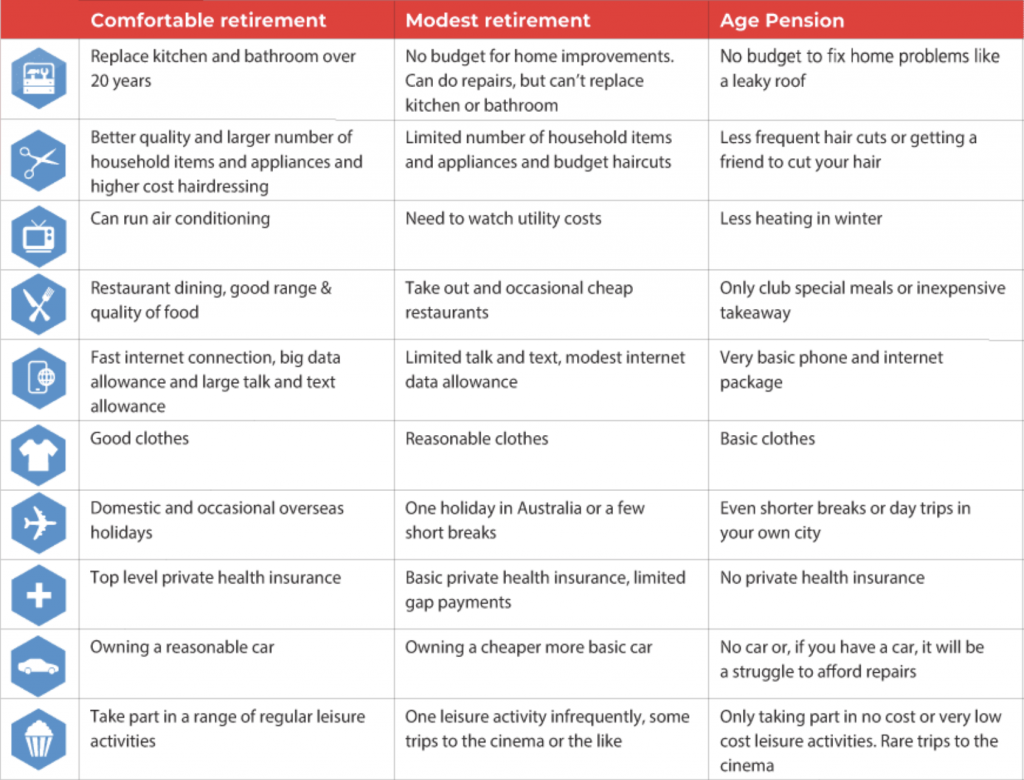

For a modest way of life, think essential living expenses, taking holidays in Australia only and limited spending on upgrades to cars, appliances and electronic items. Things like international travel, a new car from time to time and eating out on a regular basis are definitely the trappings of the “comfortable” lifestyle category. Of course your idea of what a comfortable lifestyle looks like – and the money it takes to live it – could be quite different from the retirement standard definition and estimates.

We often refer to this table below provided by AFSA, which outlines a modest and comfortable retirement. Please note their table below assumes retirees own their own home and are relatively healthy.

The amount you earn and spend in the lead up to retirement is just one of the things that can influence your budget and spending patterns after you’ve left work. How and where you plan to spend your retirement is also going to affect how much income you’ll need.

According to a recent media release from the ASFA, budgets for singles and couples living comfortably have risen 23% and 26% respectively in the decade since the first retirement standard figures were published. The increases for a modest lifestyle are considerably higher, at 33% for a single person and 36% for a couple[1]. As the ASFA have identified the rising costs of power, food, rates and health care as the main culprits for these changes[2], it’s not surprising that the impact is greater for those living modestly. In any household budget,

these four items would be considered essentials rather than luxuries.

The modest living retirement standard figures are running well ahead of the Consumer Price Index (CPI) increase for the same period which was 28.6%[3]. But while it might seem retired people living a simple life are worse off than they were 10 years ago, changes in the Aged Pension tell a different story. In real terms, the Aged Pension rose by 70% for a single person and 54% for couples[4] during this time, making it possible for retirees to cover their living costs, in spite of major price hikes for essentials.

This is an important reminder of the significance of the Age Pension in supplementing income from your super. In fact, the latest quarterly Milliman Retirement Expectations and Spending report published in June 2017, claims the median annual expenditure of a couple aged 65-69 is just $34,858, which is only marginally higher than today’s full Aged Pension entitlement for couples of $36,301 per year.[5] But as January 2017 changes in the assets test for the Aged Pension demonstrate, it’s difficult to have certainty about your future entitlement to government benefits in retirement.

Even with the help of carefully compiled estimates, surveys and reports from the ASFA and Milliman, figuring out how much you should be saving for retirement and how best to invest it for a healthy return can be a challenge. Seeking advice from a Financial Planner can help you understand the super

balance you’re going to need to retire in comfort and come up with a strategy for working towards that target.

If you have questions about your circumstances and would like to learn more, get in touch today. We’re always happy to help.

CONTACT US

Let’s Connect

If you want to meet over a coffee (practising safe social distance), we’re more than happy to do that too.

Our standard hours are Monday to Friday from 8am – 6pm

After hour appointments are available upon request.

Write to us and we’ll be in-touch soon.

Subscribe to our latest insights and updates

Perspective Wealth Management Pty Ltd

ACN 639 529 749

Trading as Luck Financial Group is a corporate authorised representative of Millennium3 Financial Services Pty Ltd

ABN 61 094 529 987 – AFSL 244 252

The information displayed on this communication is a summary only and should not be construed as investment advice or securities recommendations. It is prepared for general information and not having regard to any particular persons investment objectives, financial situation or needs. No recommendation (express or implied) or other information should be acted on without obtaining professional advice. You are encouraged to consult a financial planner before making any decision as to how appropriate this information is to your objectives, financial situation and needs. Also, before making a decision, you should consider the relevant Product Disclosure Statement available from your financial planner. This website is for Australian residents only.

Website by Studio Quatro