Menu

FREE EDUCATION

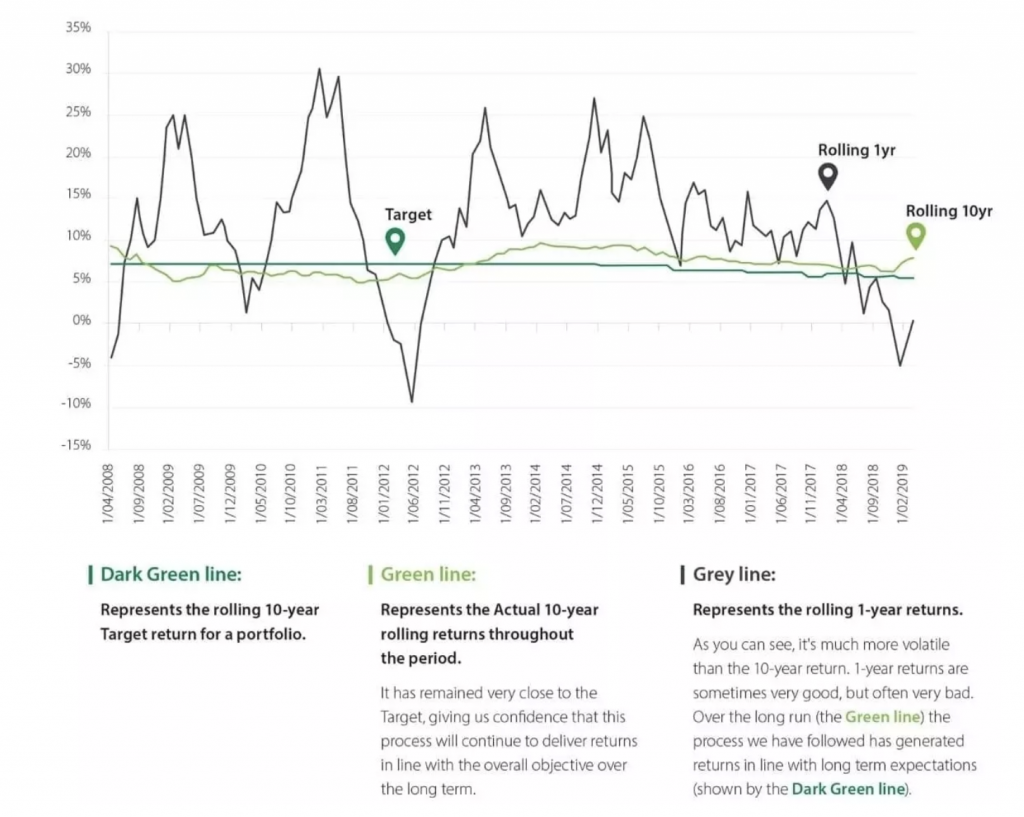

Investment results tend to vary more widely when you just consider the returns over a period of one year.

BSc. Econ, BCom, MBus

Authorised Representatives of Millennium Three Pty Ltd

ABN 61 094 529 987

AFSL 244252

Investment results tend to vary more widely when you just consider the returns over a period of one year.

Ten-year returns are generally much more stable and a lot more predictable as can be seen in the chart below.

Volatility is part of investing, and whilst we can avoid it, there’s typically a price to pay for doing so in the form of lower expected returns over the long term.

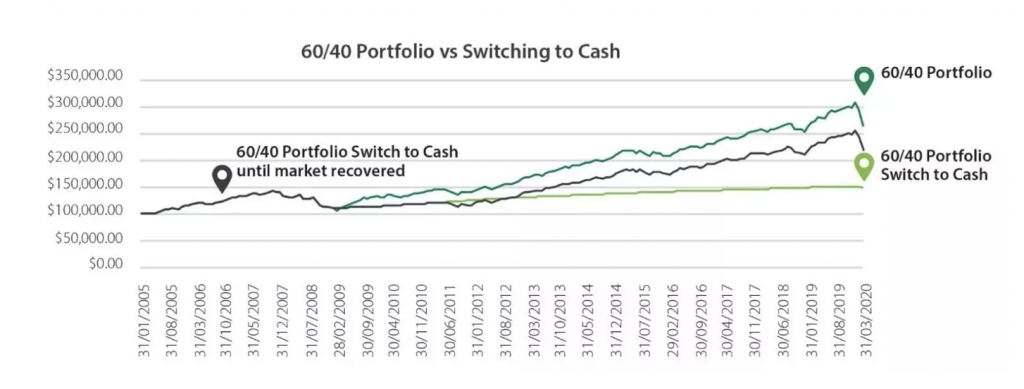

The chart below shows the impact different strategies have had on an investment portfolio over the previous 15 years.

As you can see, this example shows the volatility (dark green line) – larger moves both up and down – but highlights that by remaining ‘invested’ over the long term has resulted in a significantly higher portfolio balance at the end of the period.

The GFC was an uncomfortable investing experience, much like today’s environment. However, a well-diversified portfolio protected investors during the drawdown (this example portfolio fell by ~26% at its lowest, whilst Australian shares fell as much as 47%) and remaining in the market helped investors enjoy significant gains over the past decade.

If you have any questions or would like more information please contact us today.

CONTACT US

Let’s Connect

If you want to meet over a coffee (practising safe social distance), we’re more than happy to do that too.

Our standard hours are Monday to Friday from 8am – 6pm

After hour appointments are available upon request.

Write to us and we’ll be in-touch soon.

Subscribe to our latest insights and updates

Perspective Wealth Management Pty Ltd

ACN 639 529 749

Trading as Luck Financial Group is a corporate authorised representative of Millennium3 Financial Services Pty Ltd

ABN 61 094 529 987 – AFSL 244 252

The information displayed on this communication is a summary only and should not be construed as investment advice or securities recommendations. It is prepared for general information and not having regard to any particular persons investment objectives, financial situation or needs. No recommendation (express or implied) or other information should be acted on without obtaining professional advice. You are encouraged to consult a financial planner before making any decision as to how appropriate this information is to your objectives, financial situation and needs. Also, before making a decision, you should consider the relevant Product Disclosure Statement available from your financial planner. This website is for Australian residents only.

Website by Studio Quatro