Menu

FREE EDUCATION

Unless you’ve been living under a rock, you may have heard markets have been fluctuating with the impact of global events, including the Coronavirus pandemic.

BSc. Econ, BCom, MBus

Authorised Representatives of Millennium Three Pty Ltd

ABN 61 094 529 987

AFSL 244252

Unless you’ve been living under a rock, you may have heard markets have been fluctuating with the impact of global events, including the Coronavirus pandemic. You’re probably wondering, “What’s caused this market turmoil and how does this affect me?” Or you’re curious about the impact on cash rates, the bond market and how the Reserve Bank of Australia is responding. Let’s start with what’s going on in Australia and overseas.

Australia: The Reserve Bank has cut rates twice this month with the cash rate now at 0.25%. They will be also be buying bonds in the market.

Elsewhere: The US Federal Reserve cut interest rates there from a range of 1.50% to 1.75% to a range of 0% to 0.25%. They are intervening in the market to add US dollars to the global financial system. The European Central Bank announced more bond purchases to the tune of €120bn per month.

This comes at a time when bonds have been sold off, seeing negative returns with the Australian bond market falling 2.3% during the month (as at 18 March) after very strong returns over the last 12 months.

Central banks are institutions that cut or increase interest rates to stop the economy from getting too overheated (and inflation getting out of control) or too weak (and deflation setting in).

The cuts to interest rates are meant to help people and businesses refinance their debts at lower rates and, ideally, buy more goods and services (by increasing confidence or taking on more debt).

The Coronavirus outbreak has weakened economies around the world. Government restrictions on travel and trade hurt businesses and people in these areas, causing a loss of income. This week a good example is Qantas, with most staff being stood down until May 2020 to help the business survive the fall in people travelling right now.

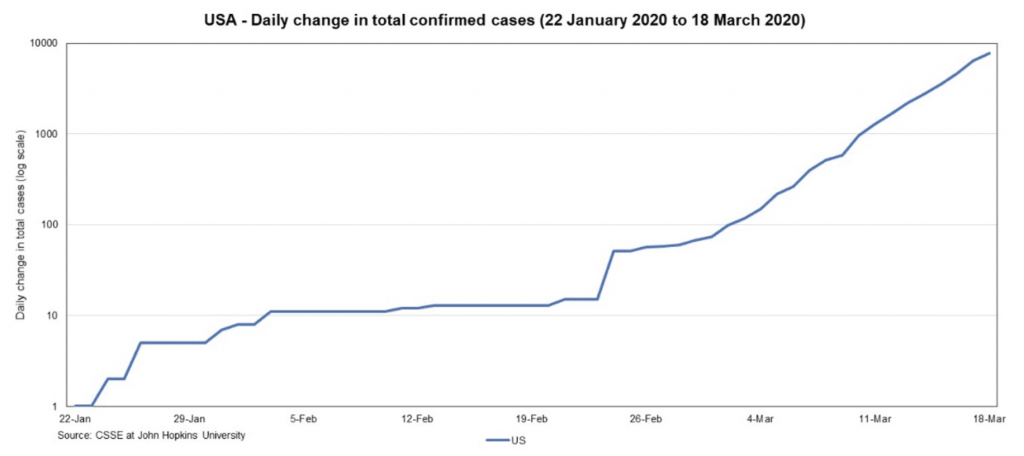

People are focused on the US and the scale of the outbreak there. Other countries are moving past their cases but in the US, daily case growth is still increasing (the US is the largest share market in the world by value). We believe fear in the market will continue until that growth in Coronavirus cases starts to slow down (i.e. the daily change starts to decrease). That will be an important sign that authorities are getting the outbreak under control.

Businesses and investors often have debts that they are required to repay regularly. There is a big market of these people borrowing short-term to help bridge gaps when they don’t have cash in hand to meet their obligations e.g. McDonalds borrowing short-term cash to pay their workers’ wages. In periods of stress the lenders trust each other and the borrowers less. They worry that other businesses are more likely to collapse and will only lend at higher interest rates.

Faced with higher interest rates, borrowers can find cash (liquidity) by selling their other assets. This includes shares and bonds. People selling these assets en masse can drive prices lower as we have seen in the share market these past few weeks. The same concerns have contributed to higher interest rates in these other markets and seen bonds get sold to meet liquidity needs.

The US dollar is the global reserve currency, this means it is widely used for trade and many commodities like our iron ore are actually priced in US not Australian dollars to make trade easier. If you require cash to meet your liabilities, bonds are one asset offering a way to get it by selling out. This is another example of why people’s need for cash drives bond prices lower.

If you have any further questions, please reach out to your adviser. Cash is not a viable long-run alternative with the cash rate at 0.25%, before you even consider inflation. Market fluctuations often occur and short-term uncertainty is common. Over the long term, diversified investment portfolios which are sensibly put together can provide the best possible chance delivering your long-term objectives.

In the meantime, please take care of yourself and be smart about sanitisation. Get in touch if you have any questions, we’re more than happy to answer any questions you have.

Important Information: This report is prepared by the IOOF Research team for: Bridges Financial Services Pty Limited ABN 60 003 474 977 AFSL 240837, Consultum Financial Advisers Pty Ltd ABN 65 006 373 995 AFSL 230323, Elders Financial Planning ABN 48 007 997 186 AFSL 224645, Financial Services Partners ABN 15 089 512 587 AFSL 237 590, Millennium3 Financial Services Pty Ltd ABN 61 094 529 987 AFSL 244252, RI Advice Group Pty Ltd ABN 23 001 774 125 AFSL 238429, Shadforth Financial Group Ltd ABN 27 127 508 472 AFSL 318613 (‘Advice Licensees’). This report is not available for distribution outside Australia and may not be passed on to any third person without the prior written consent of the Advice Licensees.

Declaration of interests: The Advice Licensees and/or its associated entities, directors and/or its employees may have a material interest in, and may earn brokerage or other fees from, any securities or other financial products referred to in this report, or may provide services to, do business with or seek to do business with the company referred to in this report. The Advice Licensees and associated persons (including persons from whom information in this report is sourced) may do business or seek to do business with companies covered in its research reports. As a result, investors should be aware that The Advice Licensees or its associates may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as a single factor in making an investment decision. A list of material interests of The Advice Licensees and its associates, and product issuers referred to in our research reports, can be found on the following IOOF website link www.ioof.com.au.

The information contained in this report is for the use of advisers of AFSL entities authorised by The Advice Licensees in writing.

General Advice Disclaimer: The information in this report is general advice only and does not take into account the financial circumstances, needs and objectives of any particular investor. Before acting on the general advice contained in this report, an investor should assess their own circumstances or seek advice from a financial adviser. Where applicable, the investor should obtain and consider a copy of the prospectus or other disclosure material relevant to the financial product before making any investment decision to acquire a financial product. It is important to note that the price or value of financial products go up and down and past performance is not an indicator of future performance.

Analyst Certification: This report has been prepared and issued by the IOOF Managed Funds Research team members, who certifies that: (1) all of the views expressed in this report accurately reflect his or her personal and professional views about any and all of the subject securities or issuers; and (2) no part of his or her compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed herein.

The writers, and/or entities in which I have a pecuniary interest, None.

The Advice Licensees believe that the information contained in this report has been obtained from sources that are accurate but has not checked or verified this information. To the extent permitted by the law, The Advice Licensees, its related bodies corporate, its directors, officers, employees, authorized representatives and agents accept no liability for any loss or damage arising from or in connection with any action taken or not taken on the basis of the information contained in this report, or in relation to, the contents of or omissions in this report.

This report is current as at the time of publication but may be superseded by future publications. You should confirm the currency of this report and obtain summary information about: material interests and Research analysts’ holdings; the qualifications and experience of the IOOF research team; and the coverage, criteria, methodology and spread of ratings from www.ioof.com.au. If an investor requires access to other research reports they should ask their adviser who can obtain these from their dealer group intranet.

CONTACT US

Let’s Connect

If you want to meet over a coffee (practising safe social distance), we’re more than happy to do that too.

Our standard hours are Monday to Friday from 8am – 6pm

After hour appointments are available upon request.

Write to us and we’ll be in-touch soon.

Subscribe to our latest insights and updates

Perspective Wealth Management Pty Ltd

ACN 639 529 749

Trading as Luck Financial Group is a corporate authorised representative of Millennium3 Financial Services Pty Ltd

ABN 61 094 529 987 – AFSL 244 252

The information displayed on this communication is a summary only and should not be construed as investment advice or securities recommendations. It is prepared for general information and not having regard to any particular persons investment objectives, financial situation or needs. No recommendation (express or implied) or other information should be acted on without obtaining professional advice. You are encouraged to consult a financial planner before making any decision as to how appropriate this information is to your objectives, financial situation and needs. Also, before making a decision, you should consider the relevant Product Disclosure Statement available from your financial planner. This website is for Australian residents only.

Website by Studio Quatro